Roku: Not A Great Business Model (NASDAQ:ROKU)

Justin Sullivan/Getty Pictures News

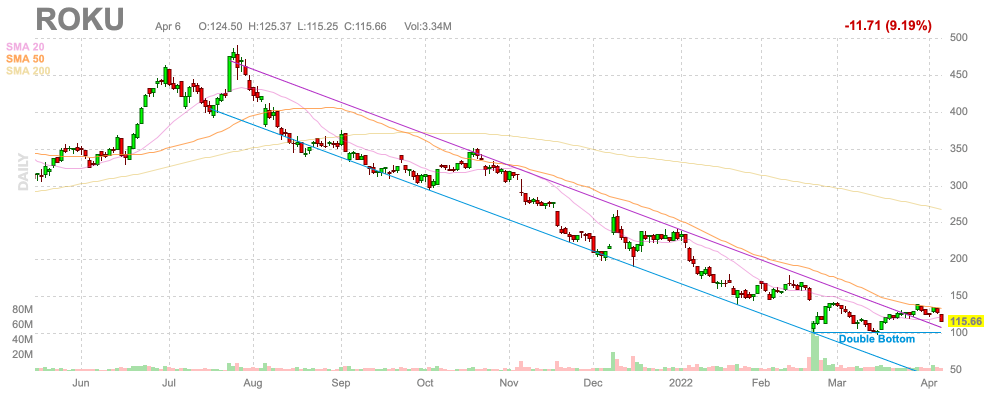

Though the streaming movie sector experiences reliable growth rates, the small business styles of the organizations concerned have not exactly lived up to grand expectations. Roku (NASDAQ:ROKU) is a primary illustration of in which limited gains are paired with powerful earnings advancement due to the charges to work in the sector although streaming revenues are lower from the legacy video clip funnel. My financial commitment thesis is Bearish on the stock irrespective of the potential tradable set up of a double bottom close to $100.

Source: FinViz

Big Account Foundation

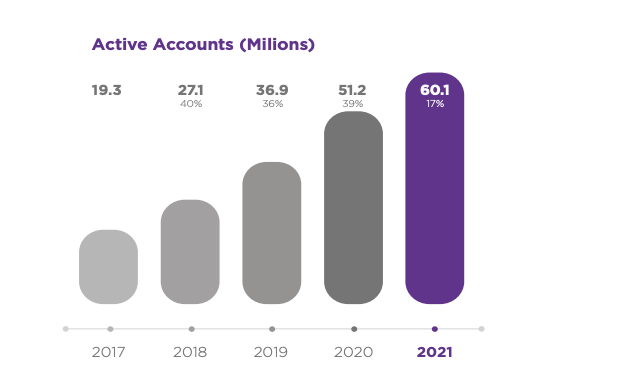

Together with the disappointing Q4’21 earnings report, Roku designed some essential statements relating to lively accounts and legacy users. In accordance to the corporation, Roku now has far more active accounts than the U.S. online video subscribers of all of the cable organizations put together.

Source: Roku Q4’21 shareholder letter

This number is remarkable for the dimension of the video clip streaming market place, but it also restrictions the quantity of potential clients to sign up. After all, Roku observed the person foundation only grow 17% in 2021 just after 3 many years of development in surplus of 35%.

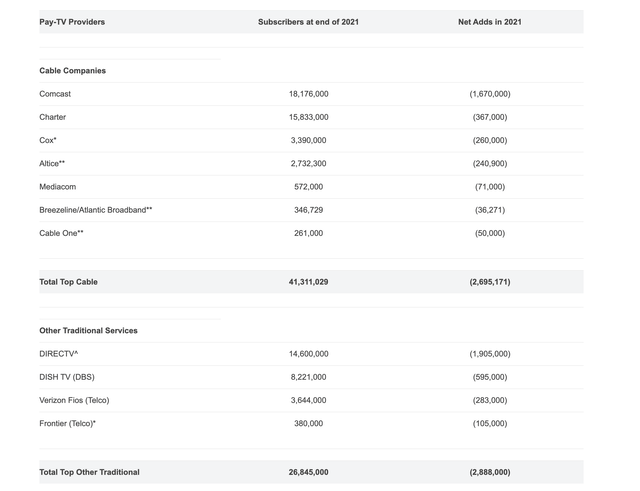

The video clip streaming system did report 8.9 million global active accounts, so the corporation isn’t just reliant on all those domestic video subs shifting to streaming. Continue to, the potential buyer foundation is slimming down. According to LRG, the legacy Pay out-Television Providers have 68.2 million subs with the cable firms possessing only 41.3 million subs soon after dropping 2.7 million accounts all through 2021 by itself.

Supply: LRG

Also, Roku mentioned that legacy movie observed a 23% decline in the important U.S. older people aged 18 to 49. All over again, this is another indication of a significant reduction in prime prospects to signal up in the long term with Roku leaving primarily the 50+ group as the majority of people nevertheless on legacy video clip providers.

In essence, Roku demands to incorporate 12 million new active accounts in 2022 to increase by 20% this calendar year. The legacy sub base will truly start out disappearing in purchase for the movie streaming services to increase at a 20% level whilst even further shrinking the sub equilibrium for 2023 and past.

Company Product

The problem with what will make the streaming video service so attractive to shoppers is what hurts the small business product of Roku. The focus on client is shifting to streaming online video to preserve from the significant cable bills while loving the overall flexibility to cancel expert services on a month-to-month foundation.

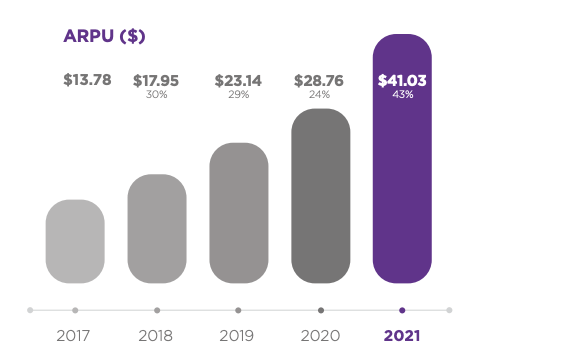

The enterprise has 60.1 million lively accounts, but the ARPU is only $41 for each year. Most cable expert services barely offer you a company that only expenditures $40 for each thirty day period.

Resource: Roku Q4’21 shareholder letter

Roku does handle to get spectacular 60% gross margins on the platform revenues leaving the enterprise with $425 million in gross gains for Q4’21. Full gross margins ended up only 44% right after taking a massive hit on Roku Gamers pushing the complete gross income down to only $380 million.

The organization has skipped revenue targets in the previous 2 quarters, in element because of to the steaming platform headwinds. Covid pull forwards have made numbers tricky to forecast and guide, but a person demands to contemplate the over account headwinds building rapidly development additional tough.

The industry is at this time way too caught up on revenue totals in comparison to cable corporations. Roku only forecasts 2022 revenue in the $3.75 billion selection though Constitution Communications is up at $54. billion. The extensive variance isn’t the somewhat age of the Roku small business, but substantially far more related to the small profits totals of the streaming platform and the cut attained by Roku for their functioning technique.

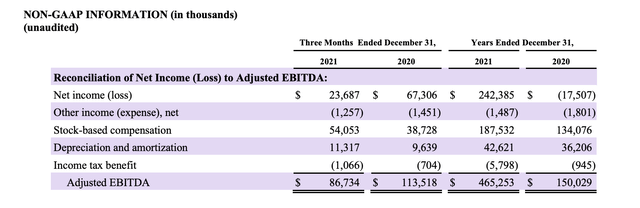

The corporation has sizeable working costs that limit the earnings of the enterprise. Roku only described Q4’21 revenue of $21.4 million with altered EBITDA up at $86.7 million thanks to inventory-based mostly payment of $54.1 million.

Altered EBITDA margins truly fell all through the December quarter to only 10%. At the identical time that EBITDA is a valuable economical metric, the share rely is surging. The common diluted shares remarkable in 2021 had been up 3.1 million shares. At the latest inventory price tag of $115, the industry cap rose practically $357 million even though the EBITDA income generated by the organization was only a bit larger at $465.3 million for the calendar year.

Source: Roku Q4’21 shareholder letter

The stock has a marketplace cap approaching $16 billion with targets for Q1’22 EBITDA to dip above $70 million YoY.

Takeaway

The key trader takeaway is that Roku is not captivating irrespective of the stock falling to $115. The streaming video clip sector continues to see a major shift in client desire, but the business by now has a substantial portion of the potential consumer foundation. As clients can easily change expert services to handle expenditures, Roku carries on to confront a hard financial gain picture the place larger ARPUs usually are not primary to larger revenue.

Traders need to stay clear of Roku until eventually the small business product adjusts to a much more successful, sticky client.