The CarMax Business Model Is Being Proven True (NYSE:KMX)

jetcityimage/iStock Editorial via Getty Images

CarMax – An Introduction

My thesis is that the CarMax (NYSE:KMX) business model is being proven true. Customers respond well to the fact that they are able to buy and sell cars without haggling. Carvana (CVNA) has had success with the same no-haggle approach on the sales side and now Carvana made an acquisition to be more like CarMax on the wholesale trade-in side.

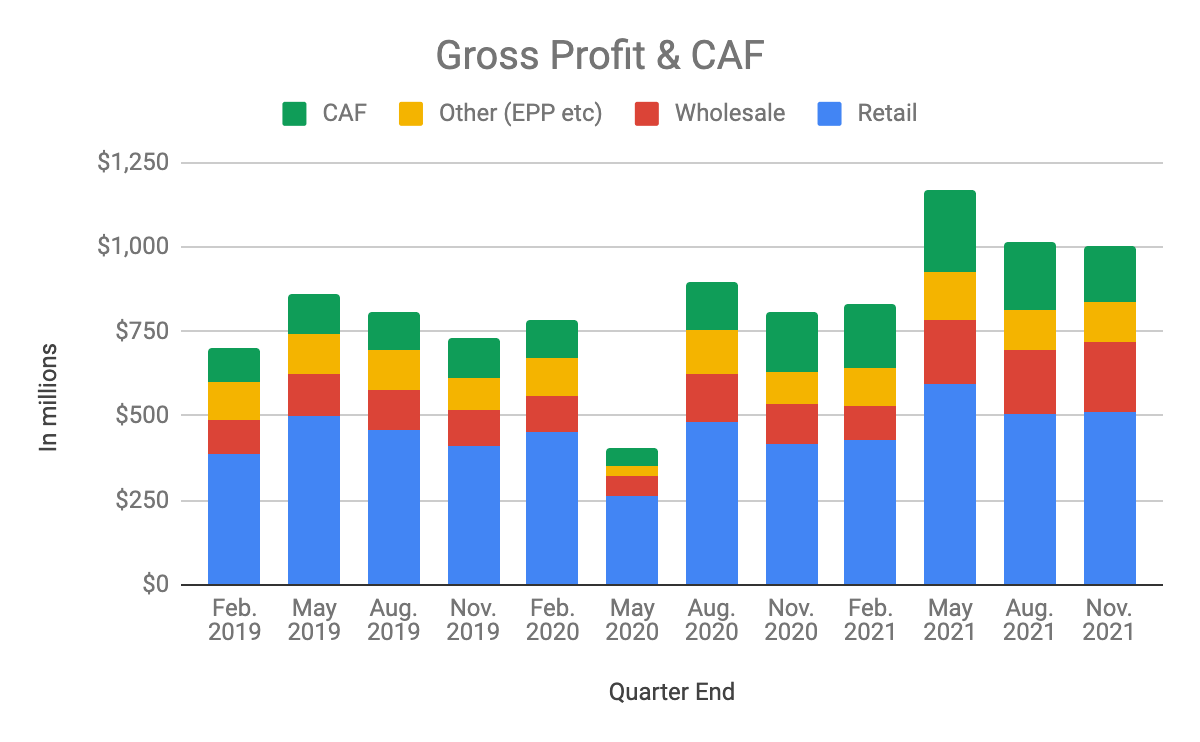

The CarMax gross profit and CarMax Auto Finance (“CAF”) numbers have climbed nicely the last 3 quarters:

Gross profit & CAF (Author’s spreadsheet)

*EPP stands for extended protection plan products.

Per the CarMax November 2021 10-Q, more than two-thirds of the CarMax retail customers now have the option to buy their vehicle online, and this is up from half of customers in the previous quarter. The 10-Q spells this out:

Currently, more than two-thirds of our customers are eligible to complete an online retail sale independently if they choose, up from slightly more than 50% in the previous quarter. In the third quarter of fiscal 2022, online retail sales accounted for 9% of retail unit sales, consistent with the previous quarter and up from 5% in the prior year quarter.

The 10-Q goes on to explain that the 4 remote components of an omni-channel sale are reserving the vehicle, financing the vehicle, trading-in an old vehicle and creating an online sales order. A sale is counted as omni-channel if at least 1 of these 4 activities is done online. In the quarter through November 2021, 57% of sales were omni-channel sales.

Retail

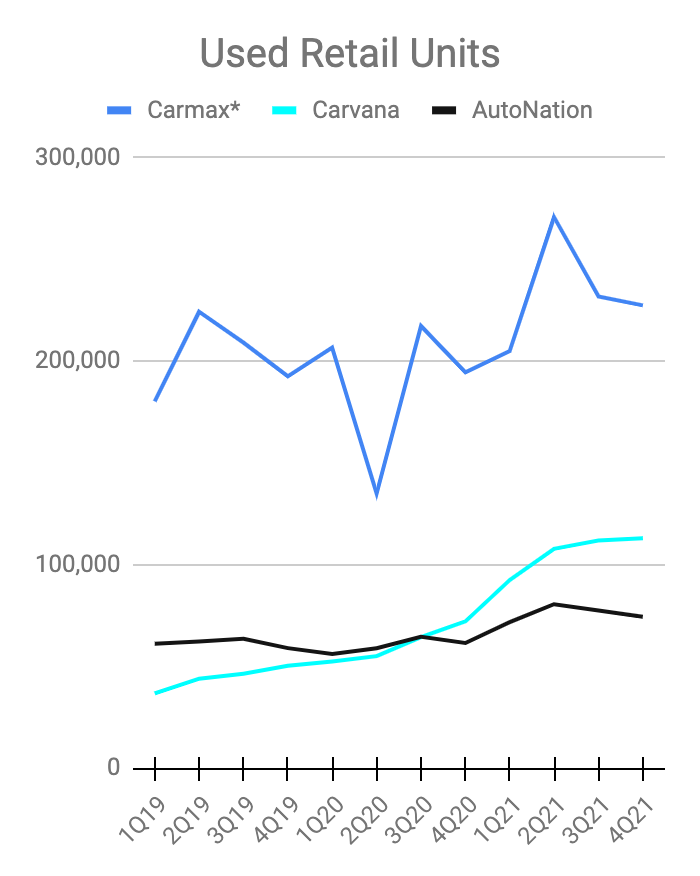

CarMax trailing twelve month [TTM] revenue for retail and other jumped from $16.2 billion through November 2020 to $23.7 billion through November 2021 as the number of units increased faster than what we’ve seen from legacy dealers like AutoNation (AN):

Used Retail Units (Author’s spreadsheet)

*CarMax ends their fiscal year in February. As such, I put their 1st fiscal quarter in the 2nd calendar quarter, their 2nd fiscal quarter in the calendar 3rd quarter and so on. In this format, it means their numbers end 1 month early.

Wholesale Contribution

CarMax TTM wholesale revenue jumped from $2.5 billion through November 2020 to $5.7 billion through November 2021.

Carvana CEO and Chairman Ernie Garcia praised the success CarMax has with wholesale in the 1Q17 call when answering Mike Levin’s question about EBITDA margins. Specifically, Carvana CEO Garcia is well aware of the way CarMax uses wholesale to boost the retail gross profit per unit:

So I think they [CarMax] are uniquely strong in wholesale and have built up that business over a long period of time, and I’m not sure there is anybody that does it better than they do. And we don’t anticipate getting to the same wholesale penetration or profit per unit that they get to. I think that is something that we will drive to over time, but that’s not something that we’re expecting to achieve to get to our $3,000 target.

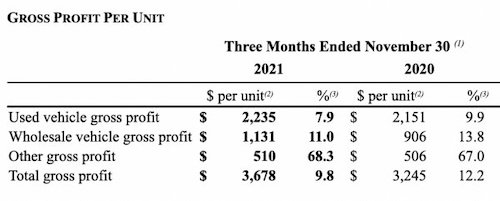

We see this in the CarMax 10-Q through November. Due to the wholesale contribution, CarMax has a gross profit per retail unit of $3,678 instead of just $2,547:

Gross profit per unit (CarMax November 2021 10-Q)

This explains why Carvana overtly announced a substantial wholesale acquisition on February 24th that makes them more like CarMax:

ADESA U.S. is the second largest provider of wholesale vehicle auction solutions in the United States with 56 sites and approximately 4,500 corporate and operations team members. Carvana will continue to operate ADESA U.S.’s existing wholesale auction business and related services under the ADESA brand. ADESA U.S. President John Hammer additional senior and executive leadership and teams will transition to Carvana after the deal is closed. The ADESA U.S. business generated over $800M of revenue and over $100M of EBITDA* in 2021.

KMX Stock Valuation

CarMax has a penchant for knowing how customers expect the car buying experience to evolve, and I believe this makes them more valuable than legacy dealers stuck in the old way of doing things.

Fiscal year 2021 ending in February 2021 was unusual because of the hard Covid quarter ending in May 2020. Fiscal year 2020 ending February 2020 was more normalized, and for fiscal 2020, we had net earnings of $888 million and adjusted free cash flow [FCF] of $648 million or $(237) million net cash from operations plus $11,786 million issuances of non-recourse notes payable less $10,709 million payments on non-recourse notes payable less $109 million share-based compensation expense less 0.25*$332 million capital expenditures on sales of $20.3 billion. The 0.25 is used because I believe only about 1/4th of capex is for maintenance.

There are some inventory abnormalities in the cash flow statement for the TTM leading up to November 2021, but the net earnings for that period are $1,201 million or 9M22 + FY21 – 9M21 or $991 million + $747 million – $537 million. If CarMax is worth 18x earnings in this low interest rate environment, then it implies a valuation of about $21.6 billion.

Per the November 2021 10-Q, there were 161,679,866 shares outstanding as of December 31, 2021. The market cap is $17.4 billion based on the February 25th share price of $107.35. My adjusted enterprise value is a little higher at around $20.5 billion, given the $2,603 million long-term debt excluding non-recourse and the $530 million long-term operating lease liabilities. I think the stock is reasonably priced seeing as the adjusted enterprise value is in line with the valuation above.